Risk Exposure, Not Prediction.

Mobby Analytics builds rule-based risk exposure systems designed to answer one critical question:How much risk should be deployed — and when.We do not forecast markets.

We do not optimize headlines.

We focus on capital deployment decisions that remain executable in real markets.

What We Do

Mobby Analytics provides a two-layer framework that separates:

-> Allocation execution for individual investors

-> Risk exposure decisioning for institutional integration

This separation is intentional — and essential.

For Individual Investors (Weekly Allocation)

A disciplined, execution-aware weekly allocation framework.Designed for investors who value clarity, consistency, and survivability.

Key characteristics:

• Rebalance frequency: Weekly

• Execution: Market-open execution

• Structure: Rules-based, non-discretionary

• Risk control: Pre-defined exposure limits

• Objective: Reduce drawdowns, avoid forced behaviorThis system emphasizes when to reduce exposure as much as when to stay invested.It is not a day-trading system.

It is not an intraday signal feed.

It is a structured allocation discipline.

For Institutions (Risk Exposure Decision API)

REDE — Risk Exposure Decision EngineA portfolio-level risk exposure arbitration layer, built to integrate seamlessly with existing strategies.What REDE provides:

• Capital deployment ratios (e.g. 100% → 65% → 35%)

• Portfolio risk state classification

• Execution-aware exposure limits

• Model-agnostic integrationWhat REDE does not provide:

• Asset selection

• Alpha signals

• Factor disclosure

• Strategy logicREDE is designed to sit above models — not replace them.Institutions keep their alpha.

REDE governs how much capital is allowed to be deployed.

{

"asof": "2025-12-22",

"equityratio": 0.65,

"riskstate": "NORMAL",

"riskbucket": "EXECUTION",

"confidenceband": "MEDIUM",

"tags": ["EXECUTIONBUFFER"],

"decisionnote": "Execution buffer applied to improve fill and fee feasibility."

}• equityratio — Capital deployment ratio (0-1)

• riskstate — High-level risk classification

• riskbucket — Primary risk driver category

• confidenceband — Stability confidence

This is not financial advice, and the system does not execute trades or recommend transactions.

Design Philosophy

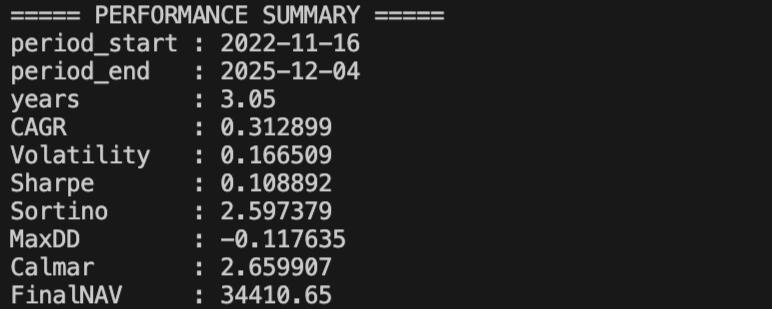

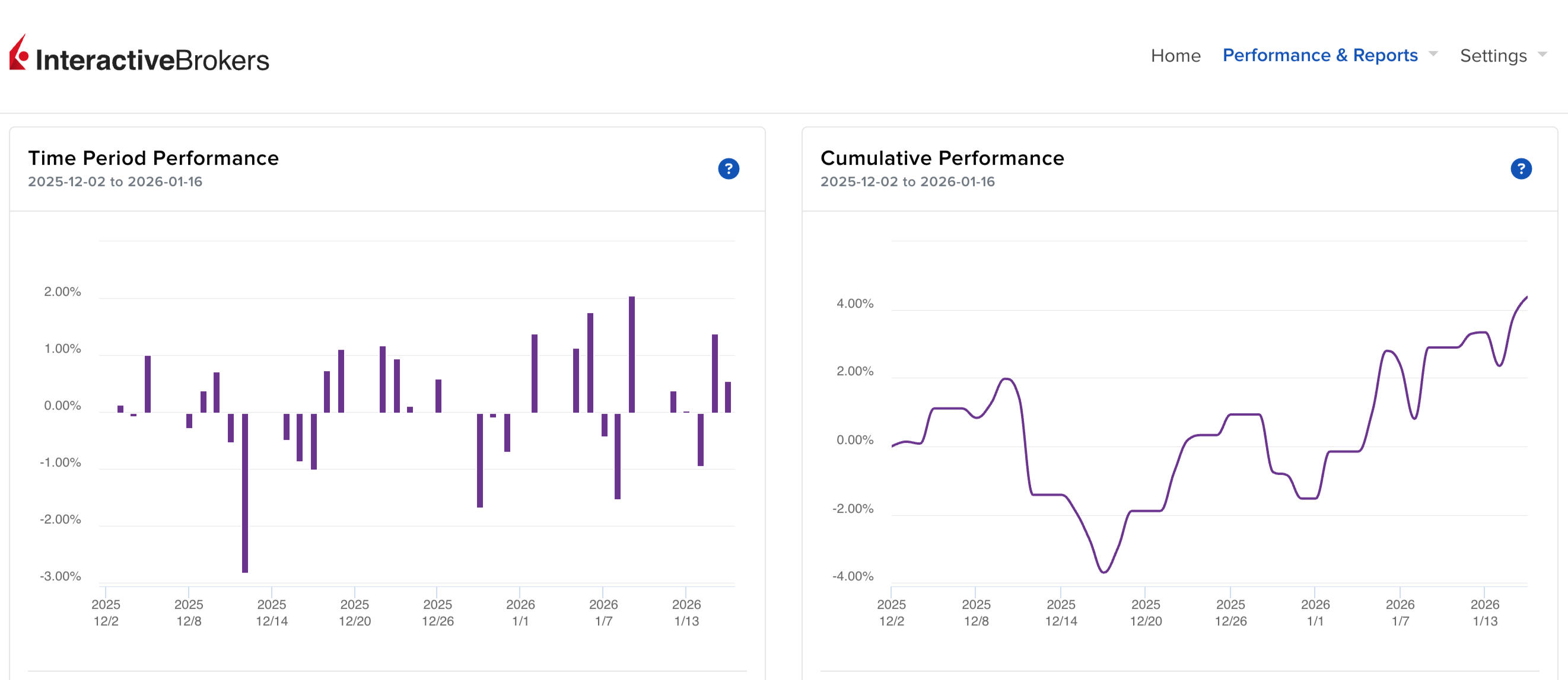

How a weekly exposure framework behaves under live execution constraints

Illustrative account-level performance shown for reference only.

This chart reflects a specific execution window under live market constraints.

It does not represent a strategy return, forecast, or investment recommendation.

Performance metrics are not the objective of the system and are shown solely to illustrate execution-aware risk control behavior.

• Risk-first, not return-first

• Execution feasibility over theoretical optimality

• Explicit rules, not discretionary overrides

• Separation of research, execution, and exposure controlInternal diagnostics and factor logic are intentionally abstracted to ensure robustness, security, and scalability.For inquiries: [email protected]

Start Research Trial

Individual Research Plan — Trial Access

Research Access

• Weekly research signals (JSON)

• TradingView private indicators

• Model allocation breakdowns

• Email delivery

• Cancel anytime

Research only. Not financial advice.

Institutional Research Plan — Evaluation Access

Research Access

• Portfolio-level risk exposure decisions (not alpha signals)

• API / JSON / Webhook integration

• Execution-aware exposure control (fees, slippage, capital buffer)

• Designed to sit on top of existing models

• Support for quantitative and risk teams

• SLA-backed service availability

Compliance Disclaimer

The material provided by Mobby Analytics Inc. is for educational and informational purposes only.

Nothing herein constitutes:

• investment advice

• trading advice

• portfolio management

• a recommendation to buy or sell any securityMobby Analytics is not an investment advisor and does not manage client assets.

All models are hypothetical and for research use only.

Past performance does not guarantee future results.

© 2025 Mobby Analytics Inc. All rights reserved.